As central banks continue to raise interest rates to balance supply chain problems, the economic system as a whole indirectly slows down growth. The US also raised interest rates by 75 basis points, and also hinted that it will raise rates by 125 basis points in 2022, which further increased risk aversion and led to a significant reduction in demand. demand for risky assets, causing the SP500 to continue to decline.

From a technical analysis perspective, we can see that price action has a breakout support area. Besides, the 4-hour EMA (Exponential Moving Average) has started to show a crossover below. Therefore, SP500 may attempt to take a short position at 3700.

DJ30

As central banks continue to raise interest rates to balance supply chain problems, the economic system as a whole indirectly slows down growth. The US also raised interest rates by 75 basis points, and also hinted that it will raise rates by 125 basis points in 2022, which further increased risk aversion and led to a significant reduction in demand. demand for risky assets, causing the DJ30 to continue to decline.

From a technical analysis perspective, we can see that price action has a breakout support area. Besides, the 4-hour EMA (Exponential Moving Average) has started to show a crossover below. Therefore, SP500 may attempt to take a short position at 29500.

HK50

As the Hong Kong Monetary Authority raised interest rates by 75 basis points to 3.5% on September 22 and also the fifth rate hike this year, as the agency is trying to reduce inflation development is increasing. The market expects that all industries will experience a period of slowing growth, causing HK50 to continue to decline significantly.

From a Technical Analysis perspective, the price action broke out of the 18500 support area and the 4-hour EMA (Exponential Moving Average) on the 4-hour timeframe shows a bearish bias. Therefore, we can try short selling around 18185.

The Fed announced an interest rate hike by 75 basis points, leading to a short-term drop in Bitcoin. Besides, investors are increasingly concerned about wage increases in the process of addressing rising inflation. As a result, put pressure on Bitcoin. The market has started to ease sentiment towards Russia and Ukraine, which should not affect the market much. As the US consumer price index remains high, investors expect the Fed to raise interest rates more aggressively. Hence, putting pressure on Bitcoin.

According to technical analysis, Elliot Wave Theory suggests that now a move into wave 5 is possible, price action breaking strong support around 29000 indicates strong bearish momentum. Besides, in the weekly time frame, the price has also crossed the EMA (Exponential Moving Average). Therefore, Bitcoin may attempt to take a short position around the 24150 area.

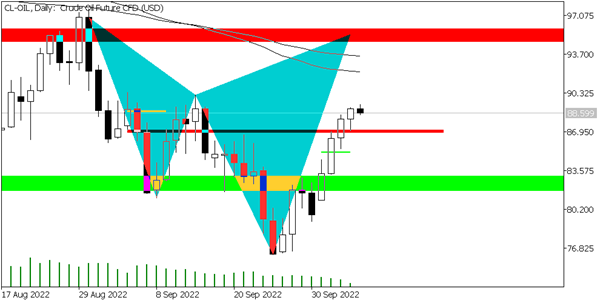

CL-OIL

Based on the central banks of countries sharply raising interest rates, and starting to reduce market demand for goods, and gradually consumer sentiment slows down, and gradually pushes the economy into recession. recession, also indirectly put pressure on crude oil. In addition, the US President's intention to increase crude oil production is also indirectly under great pressure on crude oil.

From a Technical Analysis point of view, the price action continues to form a ranging area. Besides, the 4-hour EMA (Exponential Moving Average) cross below shows strong bearish momentum. Therefore, we can try to take a short position around 80,000